Guide : How to provide liquidity to FRAX3CRV Pool on Curve.fi.

In this article, we will be explaining how to add liquidity to our FRAX3CRV pool on Curve.

It is important to understand that when you provide liquidity to a pool, you essentially gain exposure to all the coins in the pool; therefore, you would want to find a pool with coins you are comfortable holding.

1- How to get FRAX ?

- Connect your MetaMask extension to Curve.fi, then purchase the desired amount of FRAX you like to add to the liquidity using the links below:

FRAX : https://curve.fi/frax/

2- How to add liquidity to FRAX3CRV pool ?

Step 1

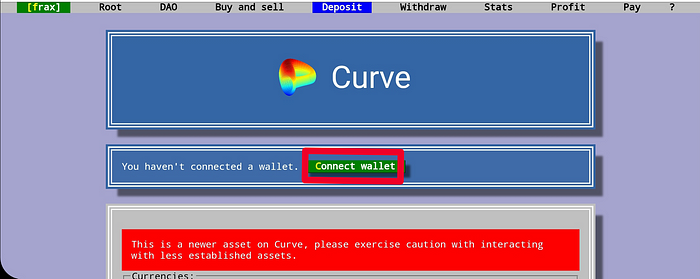

- Please head to https://curve.fi/frax/deposit

- you will arrive at this page:

Step 2

- Connect your wallet.

- A new window will appear with different options to connect your wallet, We will be using MetaMask in this guide.

- A MetaMask window will pop-up, Click “Connect” To allow Curve to access your wallet.

Step 3 (Staking)

- Enter the desired amount of FRAX tokens you want to add to Curve pool.

- Click “Deposit & stake In gauge”

- A MetaMask transaction will pop-up “Confirm”it, then wait for the transaction to be successful.

Step 4 (Liquidity gauge)

- Please head to https://dao.curve.fi/ or click on DAO.

- Search For FRAX liquidity gauge, Write the desired amount of FRAX LP Tokens you want to deposit, then Click “Deposit”.

- A MetaMask deposit transaction will pop-up “Confirm” it.

Congratulations! You’re NOW successfully staking your LP tokens.

3- How To Add additional FRAX tokens in the Curve pool that is not initially staked ?

- Click “Stake unstaked in gauge”.

- A Metamask transaction will pop-up,“Confirm” it.

4- How to claim your CRV Rewards ?

- Please head to https://curve.fi/frax/withdraw or click on withdraw

- Click “Claim” , then confirm the transaction.

About Frax Finance

Frax is the first and only stablecoin with parts of its supply backed by collateral and parts of the supply algorithmic. The stablecoin (FRAX) is named after the “fractional-algorithmic” stability mechanism. The ratio of collateralized and algorithmic depends on the market’s pricing of the FRAX stablecoin. If FRAX is trading at above $1, the protocol decreases the collateral ratio. If FRAX is trading at under $1, the protocol increases the collateral ratio.

FRAX : is the stablecoin targeting a tight band around $1/coin.

Frax Shares (FXS) : is the governance token which accrues fees, seigniorage revenue, and excess collateral value.

Website | Docs | Telegram | Twitter | Discord |Governance| Github